以下仅为参考!全文发表在《Nankai Business Review International》

即,Xueliang Han, Xiao Wang, Huijie Wang, (2013) "The inter-enterprise relationship and trade credit", Nankai Business Review International, Vol. 4 Iss: 1, pp.49 - 65.

Abstract: As the information asymmetry and credit rationing are existing, SME are difficult to gain bank credit. Trade credit, as one of substitution, gives another access to SME finance. Based on the three years panel data (from 2007 to 2009) of 196 small and medium listed companies, this paper establishes the empirical modes and examines the effects between inter-corporate relationship and tade credit. It finds that: the effects between inter-corporate relationship and tade credit seems like “U”; participate in the business associations, especially provincial associations, has positive impact to gain trade credit; good reputation also has positive impact to gai trade credit, but vulnerable to the macroeconomic. The conclusions of this paper are as follows: one corporate should keep proper relations with other corporates; pay attention to participating in the business associations, especially the provincial associations; even the macroeconomic’s impact are very important, the corporate should also pay more attention to the repution assets’ maintenance.

Keywords: Inter-enterprise Relationship Relationship; Tade Credit; Association participating; Reputation Assets; Random Model

Introduction

Trade credit plays an important role in financing. Studies have shown that: in USA, the trade credit proportion in enterprise total assets is 17.8%; in Germany、France and Italy of Europe, the proportion is more than25% (Rajan and Zingales, 1995). In China, the enterprises which cannot get loans from banks are more dependent on trade credit (Ge & Qiu ,2007;Cull R.、L. Xu & T. Zhu,2009). Uzzi(1999) argues that, if the relationship between the enterprise and bank is embedded in the social network, it will be usefue for enterprise getting loans from bank. In our mind, it is same in trade credit. Daniela Fabbri and Leora F. Klapper (2009) argues that, if the enterprise can get trade credit from its supplyer, it will be willing to offer the trade credit to his customers.

Scholars have studied the trade credit both from macro perspective and micro perspective. Under the macro perspective, scholars have studied the relationship between the trade credit and monetary policy、the trade credit and substance economic、the trade credit and the stability of financial system, etc. Under the micro perspective, scholars have focused their studieds on the motive of trade credit and its determinants, like reducing the transaction costs、pricing、promoting、 quality assurance、tax avoidace, etc. In this paper, we study the trade credit under the micro perspective. We focus on the relationship among enterprises. We want to know which kind of relationship does work on trade credit.

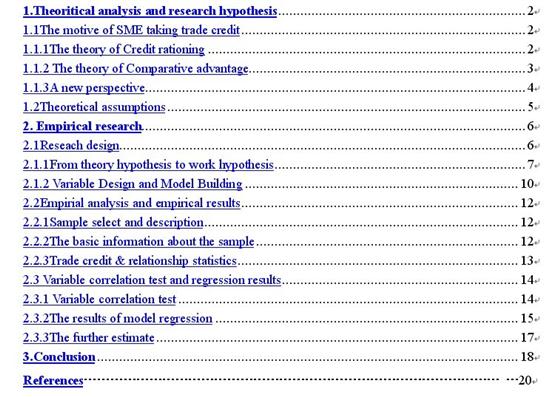

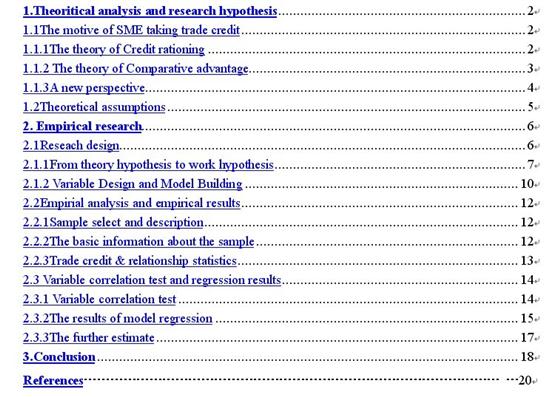

全文目录如下:

Conclusion

All of economic activities are embedded in social network. SMEs should take part in associations wittingly and establish relationship with the others. Our research shows that participating in the business associations, especially provincial associations, has positive impact to gain trade credit. At the same time, SMEs should keep independence and take action impacting on the surrounding environment, avoiding to be held up.

SMEs must pay attention to inter-enterprise relationship management. Without the power and status owned by large enterprises, SMEs have to learn how to survive in the changing and complex environment. The managers of SMEs have to develop their skills to manage the inter-enterprise relationship. It not only bring enterprises the benefits of financing, but also the benefits of producing and selling, etc.

鉴于并未公开发表,恕不提供全文。